To preface, I’m very long SaaS, and software in general. I spent the last 4 years working for a software investment fund, and now building a software company, and my personal portfolio is wildly over-allocated to SaaS.

But the current state of startup valuations, SPACs, and public market multiples has me thinking about how things might unwind, or rather a correction might occur. People have been predicting when this bubble will pop for at least 5 years (and have been consistently wrong), but I’ve never read any speculation on how it might occur.

This isn’t a critique of current market valuations. When (and if ) this hypothetical correction ever occurs, the multiples might end up back at the levels we’re seeing now. If they end up back to where they are now, are they really overvalued at this very moment?

The Build Up

While bubble popping seems to happen overnight (see Coronavirus Crash, 2010 Flash Crash, Black Thursday, etc.) the systemic upward mis-pricing in markets happens slowly, over a long period of time.

Too much capital chasing too few good opportunities leads to higher overall prices for companies with less attractive growth profiles. There will always be the top 0.01% of companies raising funding or going public at what feels like nosebleed prices. These outliers that have the potential to return funds +50x over, and attract more capital to the industry.

This starts a cycle where cheap capital leads to more software startups. Running a startup itself becomes easier as a number of these startups are solving problems for other startups (Stripe, AWS, Gusto, etc.), which leads to faster execution. Multiple suppliers emerge for every niche and every problem, all competing for the same set of customers. The removal of SaaS stickiness and switching costs through seamless data onboarding, with services like Flatfile and Hotswap. On the HR side, the switching costs of engineering talent drops through remote work - changing jobs is as easy as clicking on a different zoom link. Developers can leverage low code tools like Retool make various point solutions obsolete, tipping the build-vs-buy equation in their favor.

The First Domino - Cohort Retention

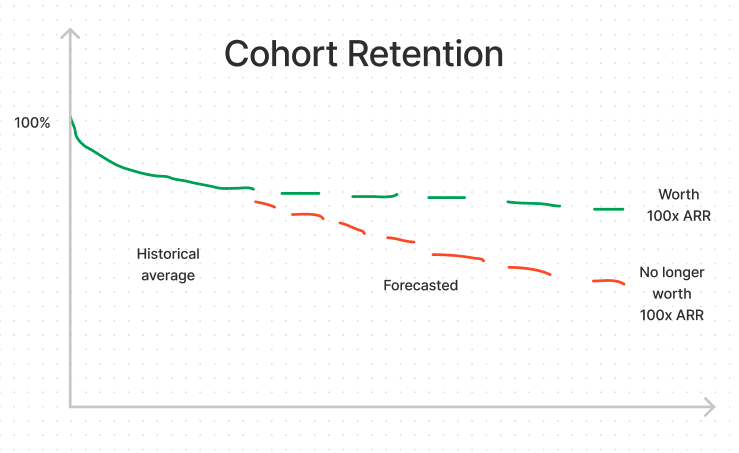

The problem arises with more startups competing for the same customers. Competitive markets often lead to price compression and retention degradation**. Long-term retention degradation may be the straw that breaks the camel’s back.** It may take 5+ years to show up, but when it does, it will wreak havoc on that company’s financial forecasts and intrinsic value.

To justify current multiples, long term retention rates need to be some above-median hypothetical percentage for companies to be long term cash flow generative. A hyper competitive software ecosystem might lead to retention rates being materially lower than what current multiples necessitate. If true, the company will look overvalued in the period where the cohort retention rates are poor. There’s nothing wrong with overpaying for an individual company based on overly-optimistic long term retention, so long as the ripple effects are relatively contained to the disgruntled investors looking at a subpar return.

The Multiplier Effects

The reality is that the modern startup ecosystem has started to intertwine on itself in ways other than just selling software to other software companies. Now they’re tied to capital markets beyond just equity and fundraising. Because very few business models generate such steady cash flow annuity streams, it is not hard to start securitizing them like mortgages.

Monthly contracts being sold for cash with Pipe.com securitizing ARR. On the D2C side, fronting digital marketing spend based on LTV/CAC models with Clear Co. And finally, let’s not forget the billions of dollars poured into the Buy-Now-Pay-Later industry in 2021.

Default Rates and Retention Rates

This new ecosystem reminds me of the interconnected nature of mortgage backed securities described in The Big Short. MBS, CDOs and other instruments that turned what should have just been mortgages defaulting into a global financial crisis. Ryan Gosling’s character mentions that everything goes bust at 8%. There’s an uncanny similarity with rates of return in lending and rates of retention in software.

If the gross revenue retention drops to, say 75%, how many of these companies are now “sub-prime” despite raising at 100x ARR?

The Counter - I’m Still Long SaaS

Some other caveats as we conclude this thought exercise. We’re nowhere near the level of the housing market pre-2008 (i.e. NINJA loans) and there are a lot of other factors at play here in software, beyond simply the greed that drove the ‘08 bubble. Software has done a lot of good for the world beyond just make a lot of people rich.

Another counter-argument is that it was already obvious loans were defaulting in ‘08 when these investors started to make these short investments. Now you can’t really short a private startup, but even if you could, I don’t yet see any evidence of massive retention degradation happening.

Finally, the markets for software are growing so fast, and to unprecedented sizes, that we may never see the price compression and increased churn that would tip the first domino for many years, if ever.

But if the software markets start to look like they might unwind, I’d take a hard look at which companies and business models are best poised to withstand the aftershocks mentioned above.

Update 12.23.21

I wrote this in early October, and it seems like some combination of inflation, omicron, and interest rates have pushed the SaaS world into correction territory. Not quite a big short but interesting timing…

Update 9.9.22

I guess I called the top 😮